The Ultimate Guide To Dubai Company Expert Services

Wiki Article

The Greatest Guide To Dubai Company Expert Services

Table of ContentsThe Single Strategy To Use For Dubai Company Expert ServicesThe Definitive Guide for Dubai Company Expert ServicesWhat Does Dubai Company Expert Services Do?Excitement About Dubai Company Expert ServicesThe 25-Second Trick For Dubai Company Expert Services

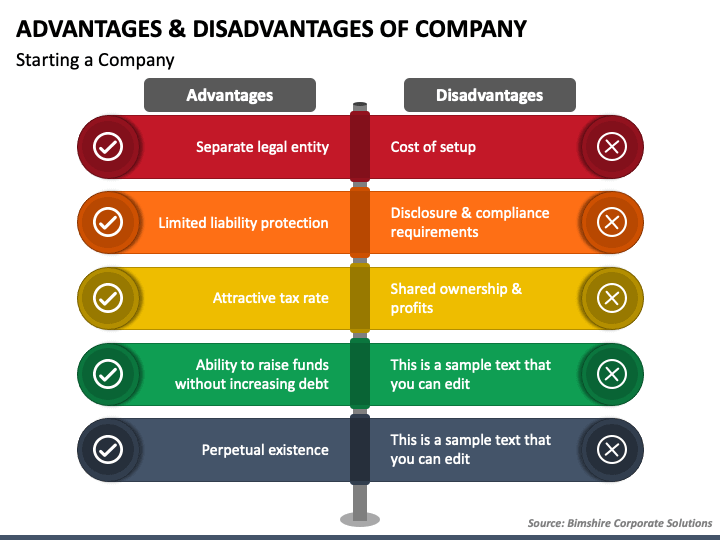

If one shareholder has more than 25 percent of the shares, they are treated in business legislation as 'individuals of substantial interest' due to the fact that they can influence decisions made regarding the organization. Private restricted business provide a number of essential advantages compared to services operating as single traders. As a sole trader, you are directly accountable for all the debts and liabilities of your business.That minimizes the risk of having your personal assets took to pay for the financial debts of business if it fails. Connected: Everything you need to understand about Lenders as well as Borrowers A personal minimal company is perceived as more substantial than companies run by a sole investor. When consumers put orders or honor agreements, they wish to be positive that the distributor has the sources to offer a trustworthy solution.

Connected: What is EIS? - choice financing choices for local business Connected: What is SEIS? - Alternate small company funding Sole traders pay income tax obligation and also National Insurance policy payments on the revenues of the service via a yearly self-assessment income tax return. Dubai Company Expert Services. The rate of income tax as well as National Insurance coverage payments is equal to that of an exclusive person and includes the very same individual allowances.

You can likewise increase capital by marketing shares in your company, although you can not offer them for public sale. Associated: A guide to crowdfunding as well as the best crowdfunding websites UK When you register your company name with Firms Home, the name is secured and can not be utilized by any other organization.

Not known Details About Dubai Company Expert Services

If Business Home recognise a matching name or a name that is very similar, they will suggest the business as well as decline to provide permission. This level of security makes it hard for other companies providing copies of your items can not 'pass-off' their items as real. Related: Legal elements of starting a little organization.As rewards are taxed at a reduced rate, this will reduce your tax obligation bill and give a more tax efficient approach of remuneration compared with salary alone. There are additionally various other methods to take money out of the company as a director, consisting of reward payments, pension plan payments, directors' car loans and private financial investments.

Sole traders do not have the same flexibility. They take revenue from the profits of the company and also the income is strained at standard individual income rates.

It exports nearly S$ 500 billion well worth of exports each year with the result that this country with only 5. 25 million individuals has actually amassed the 10th biggest foreign currency books in the globe.

Getting My Dubai Company Expert Services To Work

Business earnings are not dual exhausted when they are passed to investors as rewards. Singapore charges one of the cheapest worth added tax prices in the globe.These arrangements are developed to guarantee that economic deals between Singapore and the treaty country do not struggle with dual tax. Furthermore, Singapore offers Unilateral Tax Credit scores (UTCs) for the instance of nations with which it does not have a DTA. Therefore, a Singapore tax resident business is extremely unlikely to struggle with double tax.

You do not need any local companions or investors - Dubai Company Expert Services. This allows you to start a business with the kind of capital framework that you want and also disperse its possession to fit your investment requirements. There are no constraints on the quantity of resources that you can bring from your residence nation to invest in your Singapore business.

No taxes are imposed on funding gains from the sale of a company. This frictionless activity of funds across boundaries can offer click here for more severe flexibility to an organization.

The 30-Second Trick For Dubai Company Expert Services

Singapore has one of one of the most reliable and bureaucracy-free regulative structures worldwide. For nine consecutive years, Singapore has actually rated top on Globe Financial institution's Convenience of Operating study. The requirements for incorporating a business are straightforward and the procedure for doing so Continue is basic. It takes less than a day to incorporate a new firm.

The port of Singapore is among the busiest in the whole globe as well as is classified as a major International Maritime Center. Singapore's Changi Airport is a top quality airport that caters to about 20 million passengers annually and offers practical trips to nearly every major city in globe.

Singaporeans are some of the most effective and well qualified employees worldwide. The country's outstanding education and learning system generates a workforce that is great at what it does, yet on incomes it is incredibly affordable with various other countries. Singapore is perceived generally adhering to, well-functioning, modern-day and also truthful country.

By finding your service in Singapore, you will certainly signal expertise and also quality to your customers, partners as well as vendors. The impression they will certainly have of your organization will certainly be that of a specialist, skilled, truthful, as well as well-run firm.

Everything about Dubai Company Expert Services

Take into consideration the following: The legal rights and legal obligations of those who participate in the organization That controls business and also the degree of control you intend to have How complex you want the firm's structure to be The life expectancy of business The funds, consisting of tax obligations, debt, and liabilities Your above considerations will determine the type of company you'll create, go to this site however you ought to probably get legal advice on the best type of firm for your scenario.

This is just one of the most convenient means to begin a service as well as the most common kind of organization. Like a single proprietorship, a partnership is easy to create, yet it entails 2 or even more people. In this kind of configuration, participants might just as split the revenues as well as losses as well as carry the responsibility, unless a created agreement specifies just how these things are to be shared.

Report this wiki page